INDEPENDENT ALTERNATIVE INVESTMENT ADVISORS

Relationships and Trust are the cornerstones of Riva Capital.

We employ our multi-decade experience advising and guiding clients to create bespoke hedge fund solutions to protect and grow their wealth.

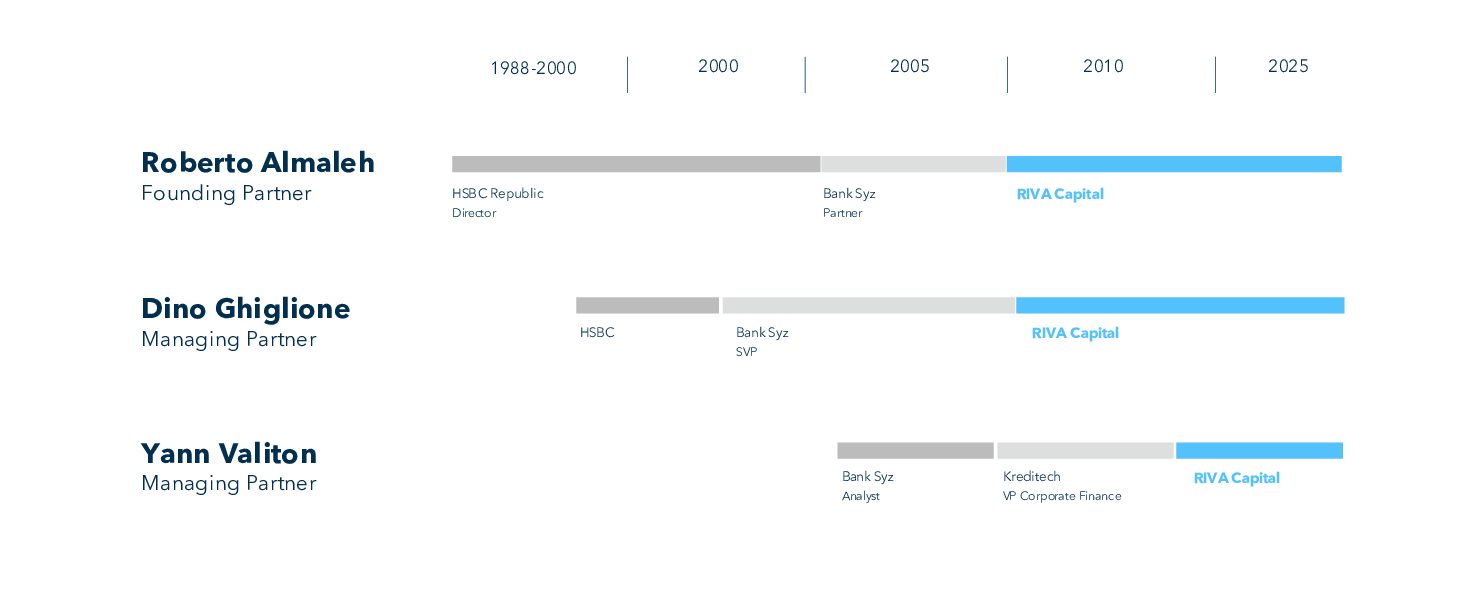

TEAM

- The team is led by Roberto Almaleh who was a Partner at Banque Syz and managed a Hedge Fund platform of USD 8 billion

- First investment in Hedge Funds made in 1989

- Over 60 years cumulative experience in Hedge Funds

FOCUS

- We provide independent hedge fund advisory to sophisticated investors

- Bespoke advisory and discretionary mandates on single hedge fund managers

- Fully independent and proprietary research

INVESTMENT PHILOSOPHY

- Qualitatively-driven investment process to identify the best single managers

- Holistic hedge fund industry understanding and monitoring

- Dynamic risk assessment (macro, strategic, operational)

EDGE

- Extensive industry network and coverage

- Sourcing talents and “best-of-breed”

- Access to high-profile closed funds

RIVA AT A GLANCE

history

- Founded in 2010 by Roberto Almaleh

- Advisory and portfolio management platform for exclusive investments in Hedge Funds

- Offices in Geneva, Gstaad and London

INVESTMENT APPROACH

- Preserving capital is our primary objective

- Disciplined process

- Proactive talent sourcing

- Objective: deliver absolute returns over the medium-term through selected Hedge Funds

SERVICES

- Single manager analysis

- Advisory

- Discretionary mandate

- White Label Products

- In house research, proprietary Due Diligence and quantitative analysis

CLIENTS

- UHNW individuals

- Family offices

- Pension funds

- Institutions

HISTORY

- Founded in 2010 by Roberto Almaleh

- Advisory and portfolio management platform for exclusive investments in Hedge Funds

- Offices in Geneva, Gstaad and London

INVESTMENT APPROACH

- Preserving capital is our primary objective

- Disciplined process

- Proactive talent sourcing

- Objective: deliver absolute returns over the medium-term through selected Hedge Funds

CLIENTS

- UHNW individuals

- Family offices

- Pension funds

- Institutions

SERVICES

- Single manager analysis

- Advisory

- Discretionary mandate

- White Label Products

- In house research, proprietary Due Diligence and quantitative analysis

TAILOR-MADE OFFERING

ADVISORY MANDATES

Whether you seek absolute or uncorrelated returns, we offer research and customized portfolio construction that aligns with your needs.

DISCRETIONARY MANDATES

- Conservative

- Balanced

- Growth

STRUCTURES

If you prefer to own your structure, we can connect you with top-tier providers who can assist you in setting up your white-label vehicle.

ADVISORY MANDATES

Whether you seek absolute or uncorrelated returns, we offer research and customized portfolio construction that aligns with your needs.

DISCRETIONARY MANDATES

After assessing your needs, risk tolerance, and investment horizon, we provide three types of discretionary portfolios:

- Conservative

- Balanced

- Growth

STRUCTURES

If you prefer to own your structure, we can connect you with top-tier providers who can assist you in setting up your white-label vehicle.

OUR EDGE

1.

- 30+ years expertise in Hedge Fund investment

2.

- No conflicts of interest

- Integrity is our main asset

3.

- Stringent methodology

4.

- Extensive industry network and coverage

5.

- Identifying and selecting talent

- Access to high-profile closed funds

6.

- Dynamic forward-looking positioning approach

1.

30+ years expertise in Hedge Fund investment

2.

No conflicts of interest.

Integrity is our main asset

3.

Stringent methodology

4.

Extensive industry network and coverage

5.

Identifying and selecting talent.

Access to high-profile closed funds

6.

Dynamic forward-looking positioning approach

client benefits

1. INVESTOR’S INTEREST AS A PRIORITY

- We provide a neutral, unbiased and independent view on existing and potential hedge fund investments

- Create customized hedge fund allocation for each client

2. ENHANCED TRANSPARENCY

- Help enhancing the level of transparency provided by managers

3. DYNAMIC RISK ASSESSMENT

- Focus on a holistic risk understanding: qualitative, quantitative, operational and macro

4. LIQUIDITY

- When possible, negotiate best liquidity terms for clients

- Favor liquid strategies

- and avoid liquidity mismatches

5. COST EFFICIENCY

- All-in advisory solution

6. EXIT

- Define clear exit strategies for each investment proposal

1. INVESTOR’S INTEREST AS A PRIORITY

We provide a neutral, unbiased and independent view on existing and potential hedge fund investments

Create customized hedge fund allocation for each client

2. ENHANCED TRANSPARENCY

Help enhancing the level of transparency provided by managers

3. DYNAMIC RISK ASSESSMENT

Focus on a holistic risk understanding: qualitative, quantitative, operational and macro

4. LIQUIDITY

When possible, negotiate best liquidity terms for clients

Favor liquid strategies

and avoid liquidity mismatches

5. COST EFFICIENCY

All-in advisory solution

6. EXIT

Define clear exit strategies for each investment proposal

Investment process

TOP-DOWN ANALYSIS Macro Input Market View

- Overview of current macro environment + Outlook

- Best /Worst strategies & Themes + Tactical allocation

DISCOVERY PHASE Phase Manager Identification

- Idea sourcing & Screening: Riva’s proprietary network, industry news, databases

- Classification

- Data/Docs collection

SINGLE MANAGER ANALYSIS Analysis Qualitative Research & Due Diligence

- Onsite Visits

- Operational Analysis

- Macro Scenario Analysis

- Quantitative Analysis

RECOMMENDATION Approved List : Entry/Exit Exit Reasons :

- Underperformance

- Operational issues

- Macro changes

- Black list

(confidential and proprietary)

INVESTMENT Allocation & Position Sizing

- By risk profile

- By liquidity profile

- Upon capacity available (for closed managers)

MONITORING Ongoing Risk Monitoring

- Qualitative

- Macro

- Statistical

- Operational

REPORTING

-

HF League

Weekly quantitative and statistical fund monitoring

-

HF News

Weekly collection of interesting manager letters

- Monthly in-house portfolio reporting Produced with PackHedge™ by FinLab

- HF Synopsis (Fund Quantitative and Strategy Description)

- Ad-Hoc Fund Quantitative Analysis

- Reporting and quantitative research are performed in-house

biographies

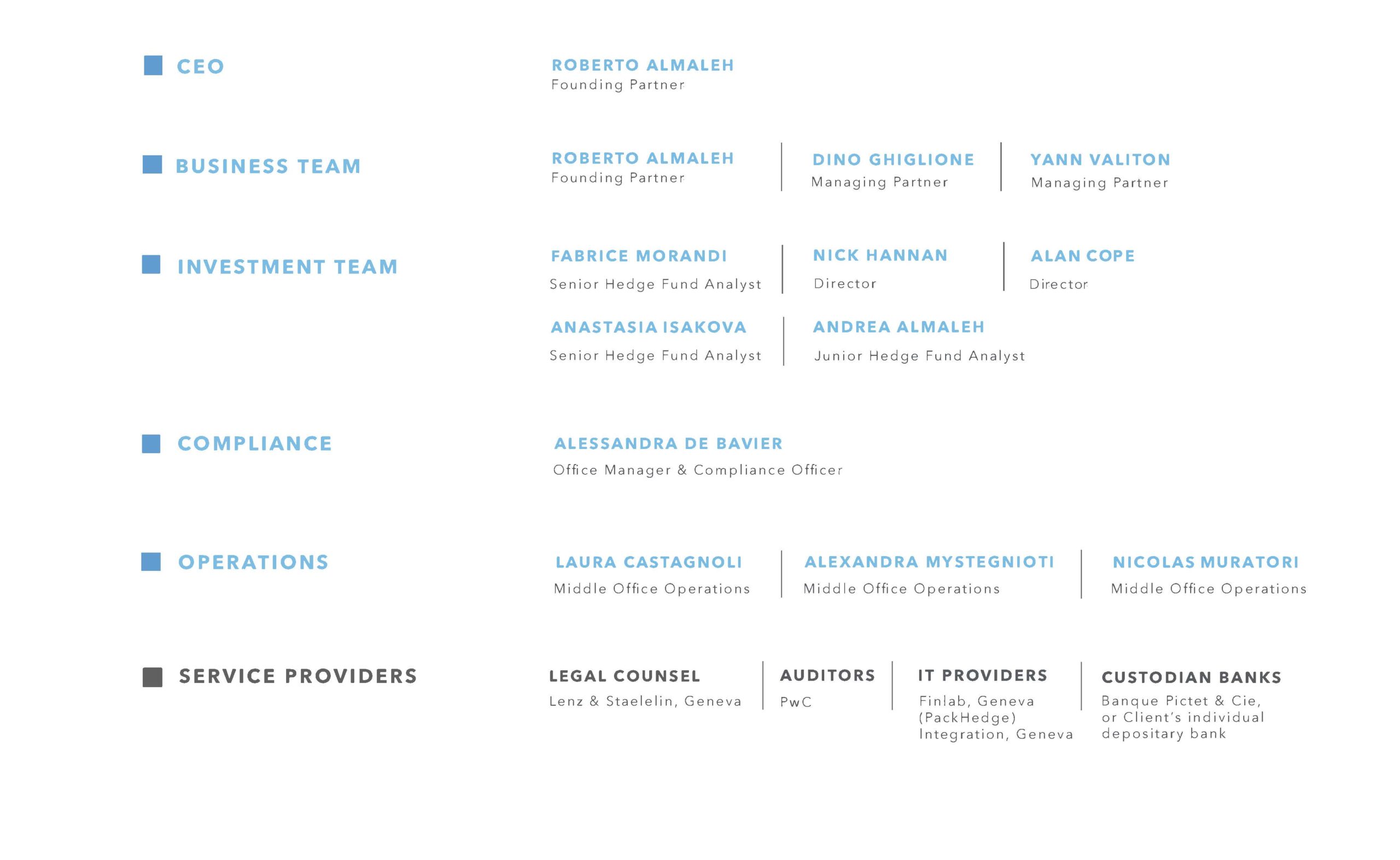

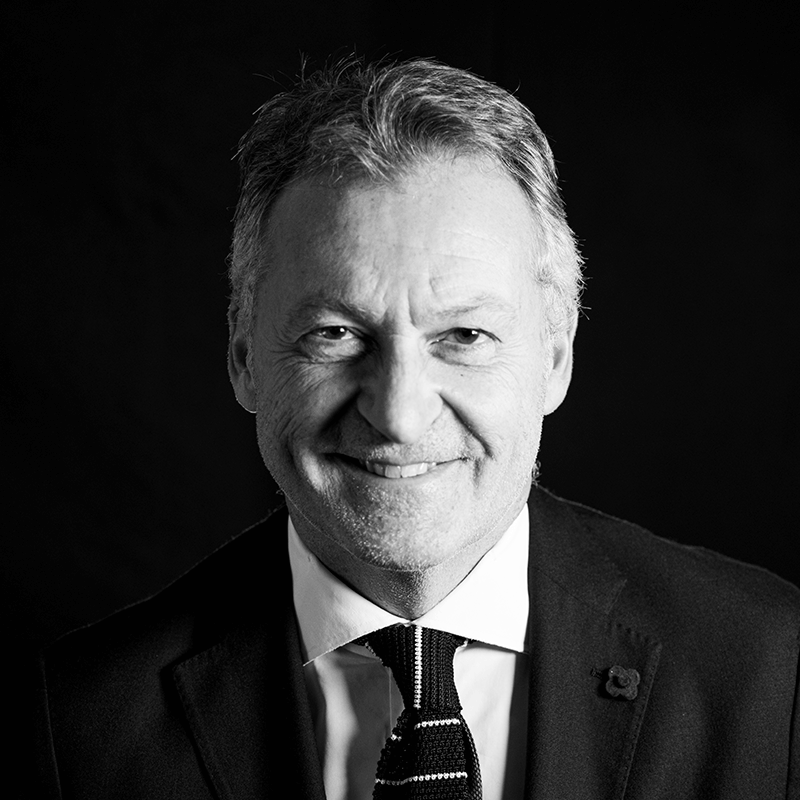

ROBERTO ALMALEH

Founding Partner

Founding Partner of RIVA Capital SA in September 2010, in charge of asset allocation, fund selection and manager analysis, including on site due diligence, and client relations.

More about Roberto Almaleh

- Prior to forming RIVA Capital SA, Mr. Almaleh served as Partner, Director and Head of Hedge Advisory Group with Banque Syz until August 2010. Responsibilities included hedge fund selection, asset allocation for discretionary alternative mandates and client relations.

- Mr. Almaleh joined Banque Syz in 2003 as an Executive Vice President after 15 years in the same field with HSBC Republic (Republic National Bank of New York until 1999), initially in New York, then in Geneva from 1988.

- Prior to working with Republic National Bank of New York in Geneva, he served as a relationship manager with EF Hutton in Geneva for their equities and commodities markets areas.

- Mr. Almaleh began his career in the private banking department of Trade Development Bank in Geneva.

- In September 2003, Roberto Almaleh created the Hedge Advisory Group within Banque Syz, the private banking unit dedicated to the specific needs of private investors wishing to invest directly in hedge funds. This Group has been highly successful, offering a unique range of services and deep knowledge of this demanding market.

- In seven years Roberto Almaleh and his team raised CHF8 billion in client assets due to the quality of his network and reputation in the alternative investment industry, positioning Syz as a significant industry participant.

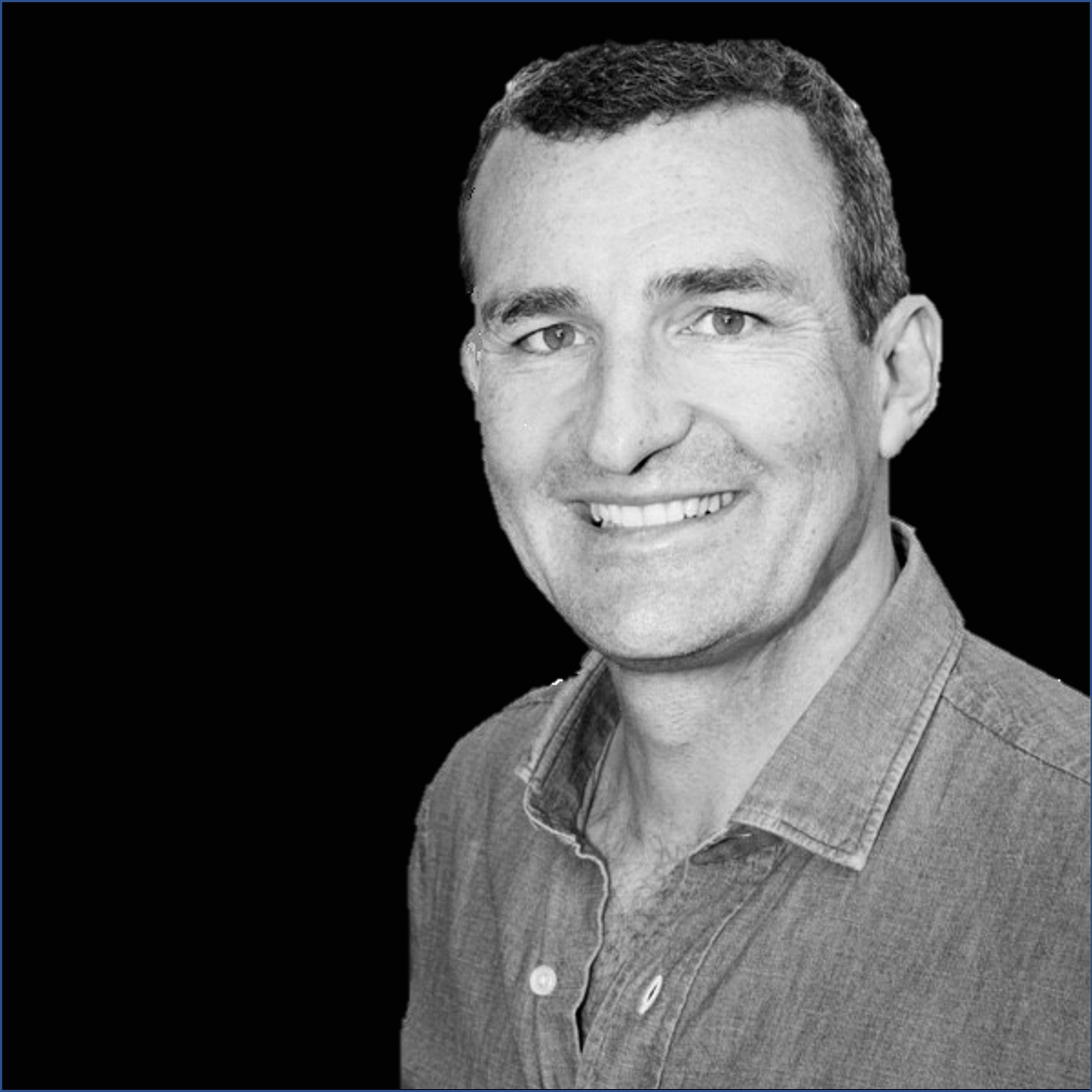

DINO GHIGLIONE

Managing Partner

Mr. Ghiglione joined RIVA Capital SA in February 2011. His responsibilities include client relationship management, fund selection and manager analysis, including on site due diligence.

More about Dino Ghiglione

- From January 2004 to August 2010 Mr Ghiglione served at Banque Syz as Senior Vice President and was responsible for Client Relationship Management, Hedge Fund Manager visits, Client reporting, Development and the implementation of the Group’s internal Hedge Funds NAV database.

- From January to December 2003 he was responsible for Hedge Fund Analysis and selection, as well as, Mutual Funds and Structured Products Selection at Société Générale Private Banking (Suisse) S.A.

- From May to December 2002 he was Junior Hedge Fund Analyst at HSBC Private Bank (Suisse) SA within the Fundinvest group, which was founded by Mr Almaleh.

- Mr Ghiglione earned an MSc from the Swiss Federal institute of Technology in Lausanne (EPFL) in the field of Microtechnology with orientation in Integrated Products. He then continued with postgraduate studies at HEC Lausanne and earned his « Certificat d’études en management ».

- Mr. Ghiglione is a Chartered Alternative Investment Analyst (CAIA) since October 2014.

- As an Italian and Swiss citizen, he is fluent in French, German, Italian and English and has good knowledge of Spanish.

YANN VALITON

Managing Partner

Mr. Valiton opened RIVA Capital (UK) Limited in July 2015 after joining Riva Capital SA in November 2014. His responsibilities include day-to-day management of the UK structure, fund selection, manager analysis and on site due diligence.

More about Yann Valiton

- Prior to joining Riva Capital, Mr. Valiton worked for Kreditech a “fintech” start-up company based in Hamburg. Working directly with the company’s CFO, he was in charge of the corporate finance and investor relations.

- From November 2009 to March 2013, he was a Hedge Fund Advisor at Banque Syz and was responsible for managing Hedge Fund portfolios, analysing clients’ portfolios, and sourcing investment opportunities

- Mr. Valiton started his financial career as a Hedge Fund Analyst at 3A, in charge of fund analysis and selection, covering mainly equity long short and macro strategies.

- Mr. Valiton graduated from the Haute Ecole de Gestion of Geneva in 2006, holds a Bachelor of Applied Science (BASc). In addition, he holds a Master of Business Administration (MBA) from the IAE Business School in Buenos Aires.

- Fluent in French, English and Spanish.

NICK HANNAN

Director

Nick Hannan joined RIVA Capital in 2023, where he oversees the London office. He is responsible for manager selection, analysis and on-site due diligence.

More about Nick Hannan

- Before joining RIVA Capital, Nick founded Veralin Partners, an independent advisory boutique focusing on alternative investment strategies, which he ran from 2018 to 2022.

- From 2005 to 2015, he was the CIO and founding partner of Oakley Alternative Investment Management. During that time, he oversaw more than 150 external fund investments.

- From 1998 to 2005, he was with LCF Rothschild Asset Management, where he joined as an analyst and was made Head of Research in 2001. He began his career at SBC Warburg in 1996.

- He graduated from City University Business School, in Property and International Finance (BSc)

ALAN COPE

Director

Alan Cope joined Riva Capital in 2025 as a Senior Analyst, he has over 15 years of investment experience.

More about Alan Cope

- Alan Cope joined Riva Capital in 2025 as a Senior Analyst, he has over 15 years of investment experience. Prior to joining Riva Capital, Alan spent almost 10 years at BNF Capital, a multi-billion dollar, London based Single Family Office.

- As a Senior Investment Analyst, he led the sourcing, analysis and due diligence effort for all new fund investments; liquid and illiquid, alongside numerous co-investments.

- Prior to BNF Capital, he spent 5 years at Headstart Advisers, a London Based Fund of Hedge Funds, focusing largely on Hedge Fund Analysis and Due Diligence. Prior to Headstart, Alan was in the sports industry both as a cricketer and then as a sports agent.

- Alan holds CISI Investment Management Certificate, and a B.A. Politics & International Relations from Loughborough University.

FABRICE MORANDI

Senior Hedge Fund Analyst

Fabrice Morandi joined RIVA Capital SA in 2023 as a senior hedge fund analyst. He has 17 years of experience in finance and 11 years in hedge funds.

More about Fabrice Morandi

- Prior to joining RIVA Capital, he was a hedge fund allocator and portfolio manager at Lombard Odier in Geneva, where he was responsible for sourcing hedge funds and constructing portfolios for an overall pool of over USD 1bn. With frequent travels in North America, Europe and Asia, his mandate included all types of strategies in both offshore and UCITS, with a particular emphasis on non-equity strategies. He also contributed successfully to finding dedicated partnerships for a UCITS platform.

- Mr. Morandi holds the CAIA and CIIA designations.

- He is fluent in French, English and Italian.

ANASTASIA ISAKOVA

Senior Hedge Fund Analyst

Anastasia Isakova joined Riva Capital SA in 2025. She brings extensive experience in hedge fund selection, analysis, and portfolio management.

More about Anastasia Isakova

-

Prior to joining Riva Capital, Ms. Isakova was Vice President at Unigestion, where she led external fund management research and managed alternative investment mandates.

-

Her work primarily focused on hedge fund strategies, encompassing sourcing, due diligence and portfolio management across a broad range of alternative investments globally.

-

From 2020 to 2022, she served as a Hedge Fund Analyst at BNP Paribas in Paris, conducting manager research and due diligence on liquid alternatives and advising institutional clients. Earlier in her career, Ms. Isakova held quantitative research roles within BNP Paribas in Singapore and Paris, focusing on fund analysis, asset allocation, and portfolio advisory for institutional investors.

-

Ms. Isakovaisa CFA Charter holder and holds a Master’s in Banking and Finance from Paris II Panthéon-Assas University.

-

She is fluent in English and French and is a native Russian speaker.

ANDREA ALMALEH

Junior Hedge Fund Analyst

Following graduation, Mr. Almaleh began his professional career at Riva Capital as an intern within the hedge fund advisory team, supporting manager research, client reporting, and investment due diligence.

More about Andrea Almaleh

-

Mr. Almaleh joined Riva Capital after gaining foundational experience at Decalia, an asset management firm, where he contributed to investment decision-making through fundamental research on commodities and fixed-income markets. His responsibilities included analyzing market dynamics, financial data, and macroeconomic trends to support portfolio strategies.

He graduated in 2021 from Cass Business School (now Bayes Business School) with a Bachelor of Science (BSc Hons) in Business with Finance, developing a strong foundation in corporate finance, economics, and strategic management.

Following graduation, Mr. Almaleh began his professional career at Riva Capital as an intern within the hedge fund advisory team, supporting manager research, client reporting, and investment due diligence.

He is fluent in English, French, and Italian.

ALESSANDRA DE BAVIER

Compliance Officer

Mrs de Bavier joined Riva Capital in June 2016, as an Executive Assistant, an Office Manager and later, as a Compliance Officer.

More about Alessandra de Bavier

- In 2020, Mrs de Bavier succeeded Vision Compliance exams and is now Compliance Officer for Riva Capital.

- Prior to joining Riva Capital, Alessandra worked as a Client Relationship officer for an Art Gallery (Opera Gallery in Beirut and Paris).

- From 2010 to 2014 she worked as an Event Manager in the Fashion Industry for Fendi and Philipp Plein International.

- From 2008 to 2010 she was Business Provider for Gallery Sebastien Bertrand in Geneva.

- She started her career working with Roberto Almaleh at HSBC Geneva from 2000 to 2004.

- Swiss Citizen, Alessandra is fluent in French, English and Italian.

LAURA CASTAGNOLI

Middle Officer

Mrs Castagnoli re- joined RIVA Capital in September 2021 resuming her role in the Middle Office Management which she held from September 2016 to July 2019 in her previous tenure at Riva Capital SA.

More about Laura Castagnoli

- From August 2019 to June 2021 she was a Financial and Fund Controller at Zeno Holding, private Equity funds. From December 2014 to August 2016 she was a business analyst at JPM Suisse SA within the Internal Hedge Fund middle office. In 2014 she was financial controller at SDG-, from 2008 until the end of 2013 she was a Treasury corporate controller and part of a project financing team at Ansaldo STS SpA.

- Mrs Castagnoli holds a Master degree in Political Science with a specialization in Sociology from the Genova University.

- Italian Citizen, Laura is fluent in English, Italian and French and has good knowledge of Spanish.

ALEXANDRA MYSTEGNIOTI

Middle Officer

Ms. Mystegnioti joined Riva Capital S.A. in January 2021. Her responsibilities include client reporting preparation, HF manager database maintenance, performance and NAV updates, assisting on producing HF publications for clients, corporate support.

More about Alexandra Mystegnioti

- From January 2015 to December 2020 Ms. Mystegnioti worked at JP Morgan Bank Suisse SA, taking over various roles: Cash Operations and Teller activities, moving in October 2017 to Hedge Funds Operations world as a Performance and Trading Support specialist.

- From May 2011 to December 2014 she worked at Euroclear Bank Brussels as Tax Specialist.

- Ms Mystegnioti holds a bachelor degree in Economics from Aristotle University of Thessaloniki. She also holds a Master in Information Technology and Business Administration.

- Alexandra is fluent in English, French and Greek, which is her mother tongue.

NICOLAS MURATORI

Middle Officer

Mr. Muratori joined Riva Capital in June 2025. His responsibilities include client reporting preparation, HF manager database maintenance, performance and NAV updates, assisting on producing HF publications for clients and corporate support.

More about Nicolas Muratori

-

In 2025, Mr. Muratori worked for 1875 Finance SA as a Middle Officer for the Multi Family Office team dealing with Cash Operations, Banking Transactions and FX Hedging. Earlier, he worked at Mirabaud & Cie SA Bank for the Finance Department.

-

From 2021 to 2023, he worked at RAM Active Investments as a Middle Officer Funds, he was in charge of all Rebates Retrocessions and Register Activities.

-

From 2015 to 2020, he worked at Pictet Canada L.P. Bank in Montreal as a Middle Officer Equities at PTS (Pictet Trading & Sales Division) dealing with the American and Canadian markets. He was responsible for all Trades Booking and Clients Allocations.

-

From 2014 to 2015, he worked at Pictet Group Bank in Geneva as a Middle Officer Management Derivatives at PTS (Pictet Trading & Sales Division).

-

Nicolas is fluent in French, English and Italian.